Behind the striking orange-and-grey façade of 222 London Road is a halal meat shop known as Supreme Butchers.

1900s: Construction of the building and the arrival of Farrow’s Bank

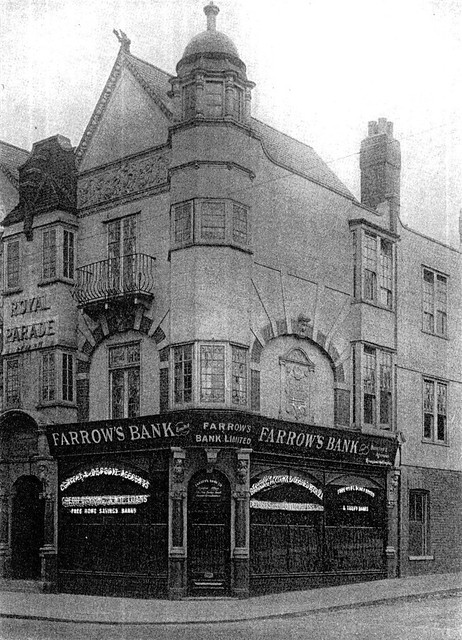

222 London Road was built in the early years of the 20th century as part of a long row of shops known as Royal Parade. Like many of the other properties in this development, for the first few years of its life it either sat empty or had only very short-term occupants who left no impact on the documentary record.[1]

This all changed in February 1905 with the opening of a new branch of Farrow’s Bank — a “People’s Bank” for those of modest means, founded by Thomas Farrow nine months previously in the City of London.[2]

Thomas Farrow: campaigner against usury

Born in Norfolk in 1862, by the time he reached his 30s Thomas had become intensely interested in the subject of usury; that is, the unethical lending of money at extremely high interest rates. In 1895 he published The Money-Lender Unmasked, where he presented the results of his first-hand research into fraudulent moneylending practices and argued for legislation to prevent this “grave social evil”.[3]

A couple of years later, Thomas was called to testify before the House of Commons Select Committee on Moneylending. Along with depositions from borrowers, lawyers, and moneylenders themselves, Thomas’s evidence led to the creation of new legislation in the form of the Moneylenders Act 1900. This Act required moneylenders to be registered with the authorities, to trade under only one name, and to operate only from their registered business premises. It also empowered the courts to amend the terms of moneylenders’ contracts where these were considered overly harsh.[4]

Despite his success in motivating the new Act, Thomas remained dissatisfied with the financial options available to those not rich enough to “obtain [credit] in abundance from Joint Stock Banks”. In September 1901, he wrote to the Westminster Gazette stating that due to “the failure of the Money-Lending Act of 1900 to suppress the evils of usury”, he had “entered upon a second ‘crusade’ with the object of securing the passage of an amending Act in the next Parliamentary Session”.[5]

Thomas followed up his announcement of this campaign with a “vigorous” and “trenchantly”-written pamphlet subjecting the Act to “close scrutiny”. Nevertheless, little seems to have come of it.[6]

Thomas Farrow’s first venture into banking: the Croydon Mutual Credit and Deposit Bank

His next attempt to tackle the situation was both more localised and more hands-on. He and his wife Beatrice had been living in Croydon since the early 1890s, and he had become active in local religious life, not least via his founding of the Croydon Religious Discussion Society.[7] In February 1903, Thomas brought Henry Devine, secretary of the National Co-operative Banks Association, to address this Society “on the aims and objects of the Co-operative Banks movement, and to advocate the formation of a People’s Bank for the Borough of Croydon”:

The idea underlying the movement was that the people should be encouraged to manage their own affairs, and to lend to themselves at a low rate of interest such moneys as they required to help them in earning a livelihood and overcoming pressing difficulties. [...] Though the bank if founded would be mainly composed of working people he strongly appealed to middle class business men and others to devote some of their time and talents to the economic leadership and enfranchisement of their poorer brethren. They must, however, do this as friends and not as condescending patrons, or more harm than good would result.

When Thomas asked for a show of hands on “the desirability of founding a Co-operative Credit Bank in Croydon”, every hand went up.[8]

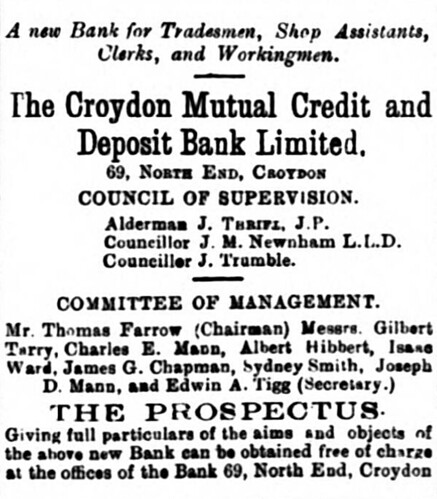

Seven months later, the Croydon Mutual Credit and Deposit Bank opened its doors at 69 North End.[9] This “new Bank for Tradesmen, Shop Assistants, Clerks, and Workingmen” was chaired by Thomas himself, affiliated with the National Co-operative Banks Association, and overseen by a “Council of Supervision” comprising three local councillors: John Thrift, John M Newnham, and James Trumble.[10]

Promising though this must have seemed at the time, rifts began to show barely half a year later. At a general meeting of shareholders, Thomas was challenged over his assertion that borrowers would never be charged more than 10% interest, with dissenters claiming that the interest rate actually worked out at 17.5% — still far below the 60% rate that Thomas had long campaigned against, but a substantial difference nevertheless. A letter from one shareholder, published in the Daily News of 13 April 1904, describes the fallout:[11]

It also appeared that the National Co-operative Banks Association has been acting as a brake upon this society, and that the Council of Supervision, consisting of two well-known Croydon Councillors,[12] had dared to differ from the committee as to the taking up of additional capital, etc. It was, therefore, decided, on the recommendation of the chairman, to withdraw from the former and abolish the latter.

Thomas was likely not displeased with this removal of oversight. Indeed, even before the general meeting he had begun writing to newspapers all over the country regarding his plans for a new “national institution with branches in every town and city”:[13]

My scheme differs in several important respects from that in operation at Croydon, and is entirely free from many restrictions which, as experience shows, tend to cripple its power for good.

This new institution — Farrow’s Bank — was officially founded on 26 May 1904 in “a small office” at 57 Gracechurch Street in the City of London. It moved to larger premises a short distance away on New Bridge Street at the end of the year, opened its first branch at Norwich in January 1905, and arrived on London Road a month later.[14]

One might wonder whether there was any conflict of interest for Thomas in having a branch of his new bank so close to the headquarters of his first one. Indeed, according to a long letter he wrote to the Croydon Guardian a few months after the opening of this branch, he had informed the shareholders of the Croydon Mutual Credit and Deposit Bank that he “should never allow a branch of my own bank to be opened in Croydon so long as I was in any way associated with the management of the Mutual Bank.”

The loophole here is clear — and in fact by the time the London Road branch of Farrow’s Bank opened, Thomas was no longer involved with the Croydon Mutual Credit and Deposit Bank. It’s unclear precisely why he left his position on the latter’s committee, but it seems not to have been an amicable split:[15]

It was by an act of treachery that I was deprived of the bank’s chairmanship, and when the plot, directed by jealousy, had succeeded in getting me out of the chair a further scheme was successfully engineered which prevented my return.

1905: A takeover attempt

Thomas made one more attempt to return to his position in charge of the Croydon Mutual Credit and Deposit Bank. In mid-1905, he wrote to the bank’s shareholders suggesting that they should consider some kind of merger with Farrow’s Bank, and at an unofficial meeting shortly afterwards he invited “as many of the shareholders as possible” to sell their shares “to Farrow’s, Ltd.” The new chairman, Charles Mann, seems to have found this attempt rather comical, informing the Croydon Guardian that:[16]

the Croydon Mutual Credit and Deposit Bank is in far too prosperous a condition for any such proposal to be considered desirable from our point of view. Doubtless Farrow’s Bank would be happy to acquire a good paying business ready made, and one cannot but smile at the coolness of the proposal [...] I may state that the business has more than doubled since Mr. Farrow’s withdrawal from the committee.

In the end, nothing came of this takeover attempt, and the two banks continued to operate separately.[17]

1920: Farrow’s Bank reaches 15 years on London Road

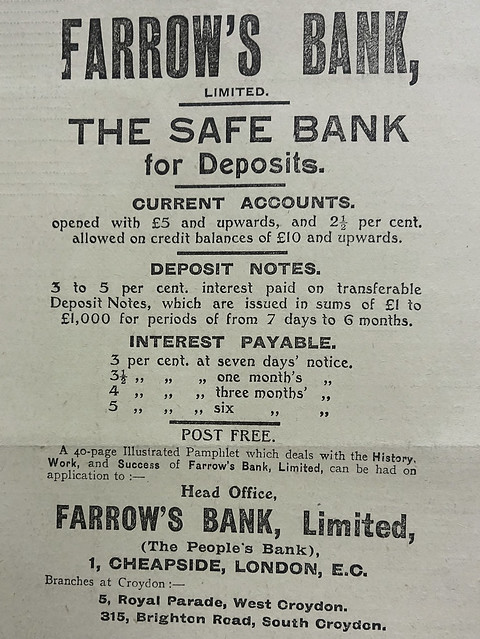

Farrow’s Bank remained at 222 London Road for the next 15 years, joined along the way by additional Croydon branches on the High Street and Brighton Road as well as several elsewhere in England, Wales, Scotland, and Ireland.[18]

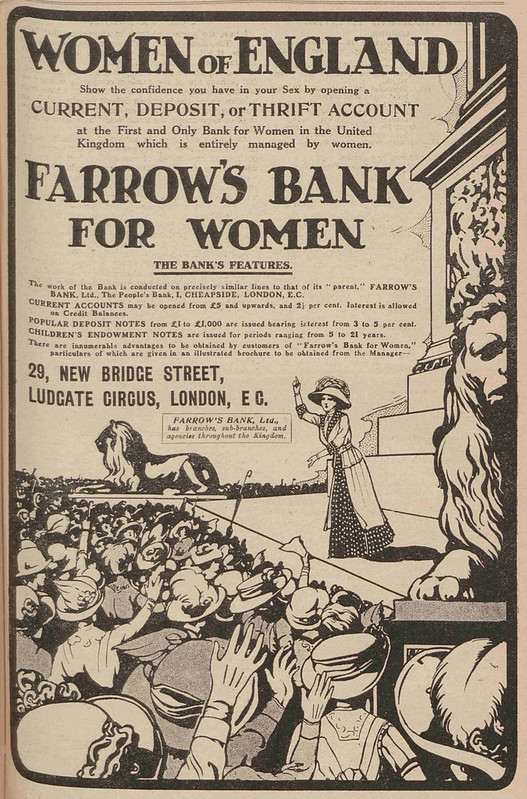

Advertising itself as “The Great Bank for Small Deposits”, it continued to focus on Thomas’s mission of catering for those with enough money to save just a little each week. It offered banking by post, paid interest on current accounts as well as deposit accounts, and opened a branch that was staffed and managed entirely by women, allowing “the woman of limited means” to enjoy “the privileges of a cheque book”.[19]

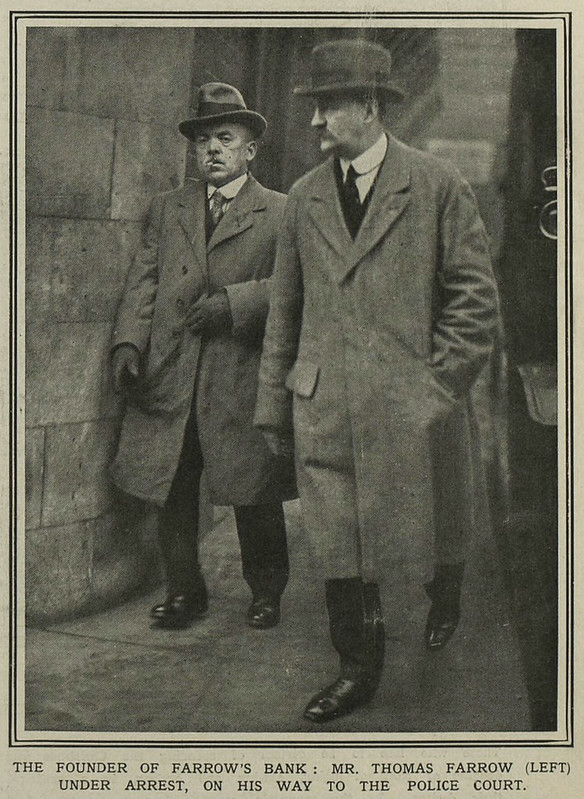

By 1920, Farrow’s Bank had more than 70 branches and was paying a dividend of 6.5%, with reported assets of £4,657,786 and a yearly net profit of £53,450 (£210m and £2.4m respectively in 2019 prices). Although a “comparatively small institution” in the national context, its depositors represented “a large number of persons of small means all over the country”. One can only imagine the shock these persons must have felt when the news broke in December of that year that Farrow’s Bank had suspended all transactions, that a petition for its compulsory liquidation had been presented, and that Thomas and two of his colleagues had been taken into custody by the police.[20]

In contrast to the beautiful picture that its directors had painted of “progress and activity” and “a really phenomenal growth” with “continuous profits and a steady increase in the reserve fund”, in reality Farrow’s Bank had lost money every year since 1908 and was “hopelessly and irretrievably insolvent”. As of 1920, salaries alone exceeded the entirety of that year’s earnings, and the total net loss stood at £1,107,000 (nearly £50m in 2019 prices), all of which had been concealed in the annual reports by artificially inflating the value of the bank’s assets and by “crediting certain funds to the profit and loss account which were not profits”.[21]

1921: The end of Farrow’s Bank

On 19 January 1921, Thomas Farrow, his fellow director William Crotch, and their auditor Frederick Hart were brought before Alderman Sir Charles Wakefield at the Guildhall Police Court, charged under section 84 of the Larceny Act with:[22]

making, circulating, and publishing [...] a written statement and account [...] of the bank which they knew to be false in certain material particulars, with intent to induce depositors and investors to entrust and advance moneys and valuable securities to the bank.

The prosecution added that “Other charges would probably have to be added as the case proceeded.”

Witnesses called over the next month and a half included an Army veteran from New Malden who had been induced to buy shares in the bank by a “fraudulent representation” in a November 1920 letter from Thomas, and a railway clerk from Manor Park who had concluded that Farrow’s Bank was “a proper place for his money” after reading a pamphlet “showing the bank to be in a very favourable position”.[23]

On 8 March the three men were committed for trial at the Central Criminal Court:

The charges against them were conspiracy to defraud, circulating false statements of accounts, and obtaining by false pretences 625,000 shares in the Caltex Oil Company, [...] a banker’s draft of £150,000 from Mr. Read [the prospective investor who had uncovered the accounts discrepancy in the first place], and various other drafts, cheques, &c., from him and other persons. The defendants pleaded “Not Guilty,” and reserved their defence.

William at least does seem to have been willing to accept responsibility for his actions. Mr Read, the investor mentioned above, told the court that when presented with evidence of the bank’s true financial situation, William “threw up his hands and said: ‘It cannot be helped; the game is up; we have been sitting on this thing for many years. [...] we thought you would get us out of our trouble, but you appear to have started more trouble for us.’”[24]

The accountant brought in by Mr Read to examine the accounts described William’s answer to his remarking on the burden concealment must have been:[25]

[He] replied that the first year they were a little short, but they had some promising properties on hand and wrote them up thinking they would materialise the next year. And so it went on, and they thought some miracle would occur to put them right.

William admitted that he had signed the 1920 accounts with “a foolhardiness I have cursed myself for ever since”, and told the court that:[26]

“Since this trial commenced it has been borne in on me with an ever-increasing sense of shame that I have been neglectful and careless of my duty to the bank. I am sorry. I make the apology publicly, because I have made the public suffer. I am sorry I did not look into these things and see where these profits were coming from.”

Thomas, on the other hand, repeatedly defended his decisions. He insisted that any manipulation of the accounts had been no worse than practices at other banks, and that it had only been his arrest that had prevented him from negotiating a deal with the government to save the bank. In a “long and emotional speech from the dock”, he claimed that:[27]

by waiting for a maximum of seven to 10 years the whole of the depositors could have been paid in full. The failure of the bank had been brought about by no fault of his. He had done his best, and he had never knowingly or willingly done anything he thought was wrong.

The jury disagreed. Frederick, the auditor, was sentenced to 12 months’ imprisonment, while William and Thomas each got four years’ penal labour.[28]

1920s–1960s: Westminster Bank

The liquidation of Farrow’s Bank of course meant the disposal of all its assets. On 14 May 1921, a notice appeared in the Times addressed to “bankers, insurance companies, and others”, stating that Douglas Young & Co had been instructed by the Official Receiver to invite tenders for the leaseholds of several Farrow’s Bank branches, including the one in West Croydon. Two months later, the lease of 222 London Road was passed to the hands of the London County Westminster & Parr’s Bank.[29]

The rather cumbersome name of number 222’s new leaseholder was a reflection of its threefold origin. Parr’s Bank, the oldest of the three, was founded in 1788 as a private banking partnership based in Warrington, while the other two — the London and Westminster Bank and the London and County Bank — were established as joint-stock banks in 1833 and 1836, respectively, and merged to form the London County and Westminster Bank in 1909. A further merger with Parr’s Bank in 1918 extended the bank’s geographical reach beyond London and southeast England to create a network of over 700 branches — ten times as many as Farrow’s Bank at its peak.[31]

The new West Croydon branch opened on 2 October 1922, operating from 9am to 3pm on weekdays and 9am to noon on Saturdays. The following year, the company simplified its name to Westminster Bank, and 222 London Road was rebranded to match.[32]

In 1965, Westminster Bank acquired the freehold of both 222 London Road and its neighbour at number 224, though it continued to operate only from number 222 for the time being. This decade also saw a merger between Westminster Bank and the National Provincial Bank. The merger was announced on 26 January 1968; and two years later, on 1 January 1970, the National Westminster Bank became fully operational.[34]

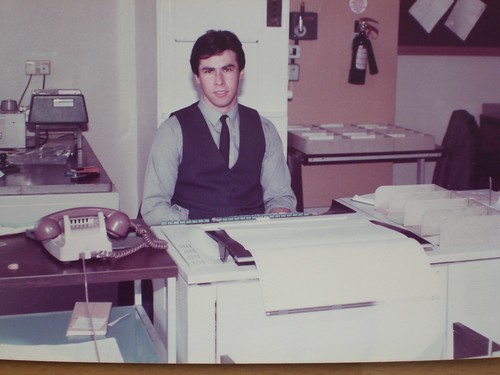

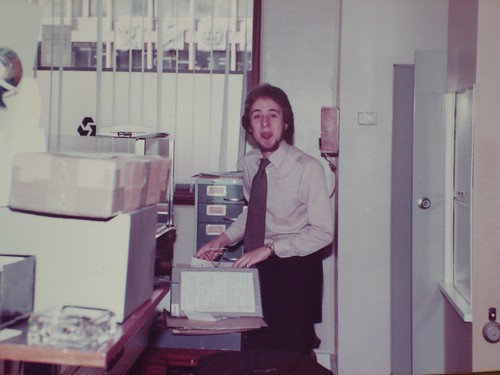

1970s–1990s: National Westminster Bank

The next substantial development in the story of 222 London Road came in the late 1970s, when the closure of Sport Craft at number 224 left room for the bank to finally expand into the premises it had purchased in 1965. Croydon Council granted permission for this on 21 February 1978, and by 1980 the new façade was in place.[35]

A cash machine was also installed around this time. John Croudy, who worked across the road in Zodiac House, found this extremely useful:[37]

I used to go there at lunch time once a week and waste my lunch break queuing up to get £50 cash to use during the week. In about 1980 the first ATM (called a “ServiceTill”) was installed there and suddenly I was able to get £50 in 5 minutes instead of wasting my lunch break!

Dave Brown, who worked in the local area from 1981 to 1985, described the process of producing cheque books for the bank’s customers:[38]

I do remember that the “junior” took the branch’s daily post every afternoon up to the Broad Green Post Office (usually in a bin liner or several plastic bags printed with “National Westminster Bank”) corner of Elmwood Road. This always included dozens of personalised blank cheque books, which were personalised at the branch using a Bradma machine.

The blank cheque books (25 or 50 pages) were held firmly in the machine. A small unique metal Bradma plate which was embossed with the customer’s name and account number was inserted in the machine. The plate then whalloped down on each page embossing the details via a huge ribbon similar to a typewriter ribbon. This mechanism printed by pressing two buttons at once, placed at either end of the machine to ensure fingers and thumbs were never squashed. It was extremely tiring and tedious as you had to flip each cheque individually to get printed.

Of course, the odd cheque slipped through unprinted, and would arrive back at the branch unprocessed as there was no customer account number or name printed. You would then refer to the “cheque book register” where the blank serial numbers were recorded. If that data was missing, the completed/signed cheque would be studied by all staff to see if they could recognise the customer’s signature or writing. Amazingly, that did happen sometimes and we never had an unsolved item, and we were able to process the cheque as if nothing was wrong.

After seven decades on London Road, the branch finally closed for good on 12 August 1994.[39]

1995: A proposal for a pub

Having spent nearly the whole of the 20th century as a bank, 222 London Road was now poised to enter an entirely new chapter of life. The initial attempt at redeployment came in late 1995, when West London brewery Fuller, Smith & Turner applied to Croydon Council for permission to use the ground floor of numbers 222–224 as a “traditional public house” with “ancillary kitchen, staff rooms and managers flat” on the floor above.

In a covering letter, Fuller’s argued that the proposed pub would “add to the variety and diversity in the street scene”, create eleven new jobs, and “serve daytime and evening users of London Road” as well as providing “a neighbourhood public house to the residential areas backing London Road”. Nevertheless, nine objections were received from individual local residents and the Broad Green Residents’ Association, citing noise, disturbance, littering, loss of privacy, parking difficulties, and reduction in property values, among other issues. One letter from a Zodiac Court resident painted an evocative picture:

In this area we are already in a situation where we have disturbed sleep due to the noise from the Cartoon Pub, Brams Wine Bar and Cinatras Nightclub; litter is becoming a problem and the behaviour of the patrons of these establishments leaves a lot to be desired after closing hours when people loiter and cause a general nuisance with fights, loud noise, urinating against various properties and other unsociable behaviours.”

Despite a planning officer’s assessment that a pub “would be appropriate given the character of the surrounding area”, Croydon Council decided to refuse the application. It did however explain to the applicant that “a restaurant use may be given more sympathetic consideration”.[40]

1990s–2000s: Viet Hoa and Tasty House

The next planning application relating to the premises was indeed for a restaurant. Although it seems that the actual operator of this restaurant had not yet been decided, the agent who made the application assured the council that a “quality dining experience is envisaged”. Permission was granted in January 1998.[41]

As of March 1999 work to convert the premises to a restaurant was still ongoing,[42] but a few months later the conversion was complete and Viet Hoa was in residence. This Vietnamese restaurant was a branch of the original Viet Hoa on Kingsland Road, which is still there today.[43]

It’s unclear how long the West Croydon branch of Viet Hoa remained open. At some point it seems to have been replaced by a Chinese restaurant called Tasty House, but little documentary evidence remains of either business.[44]

2000s: Savana, Humming Bird Restaurant, and Bar HQ

The next occupant was a restaurant known as Savana, which seems to have offered dancing as well as dining. This likely arrived at some point during 2001–2002, and remained for just a year or so.[45]

Savana was replaced by yet another restaurant; this time, a branch of one that was already established in Thornton Heath. Humming Bird Restaurant had been serving its “French Caribbean cuisine” at 23 Brigstock Road since at least 1999, and now sought to expand to West Croydon.[46]

The original intention was to use the ground floor of numbers 222–224 as a restaurant area with DJs and live music and the first floor as a “lounge/piano bar”, but Croydon Council refused permission for the latter use due to concerns over noise and disturbance to nearby residents. However, plans for the ground floor restaurant do seem to have been put into action, as by November 2003 the Council were receiving complaints about a “band playing loud music” at the premises.[47]

It’s not clear how long Humming Bird Restaurant continued to operate here, nor is it clear whether it remained a restaurant throughout its tenure. The name “Bar HQ” was also associated with the premises, and by early 2006 this was running a club night under the name of “Sexy 1st Fridays”. A planning application submitted in September 2007 described the current use of the ground floor as “a wine bar/club”, while (despite the Council’s previous refusal of permission) the first floor of number 222 was being used as “a dance floor”.[48]

2010s–present: Lobo Halal Meat and Supreme Butchers

By mid-2009, however, all dancing and dining had definitely ceased, and by late 2010 work was underway to convert the interior to a butcher’s shop. By January 2012 this was open as Lobo Halal Meat, under the same ownership as Lobo Seafood a few doors down at numbers 188–190.[49]

The next developments came a few years later, as the double premises were redivided into two shops. The butchers shop continued to operate from number 222, while number 224 remained vacant for the time being.[50]

By October 2016, Lobo Halal Meat had departed and the premises had been rented to another set of butchers operating under the name Supreme Butchers. Today, Supreme Butchers offer halal meat and offal, both fresh and frozen. While many of the other butchers along this stretch also sell at least a few shelf-stable groceries such as fufu mix or canned beans, the focus here is solely on meat.[51]

Thanks to: bob walker; Dave Brown; David Godfrey and N M Godfrey; Ewan Munro; John Croudy; Sophie Volker and Kim Harsley at the RBS archives; the Planning Technical Support Team at Croydon Council; and the staff, volunteers, and patrons at the Museum of Croydon. Monetary conversions performed using the Bank of England inflation calculator (prices < £100 given to the nearest penny, prices from £100 to < £100,000 to the nearest pound, prices from £100,000 to < £1 million to the nearest £1,000, prices from £1 million to < £100 million to the nearest £100,000, prices ≥ £100 million to the nearest million).

Administrative note: This article is twice as long as usual, so I’m going to postpone the next one to give people time to read it properly. My next article will be published on 26 June 2020.

Footnotes and references

- Ward’s directories list the property as “Unoccupied” in 1903, 1904, and 1905. Although it must be remembered that these directories are only snapshots of the situation at the end of the preceding year, they do provide evidence that any occupant during this time would have been there for less than 12 months. Moreover, a British Newspaper Archive search for “Royal Parade” in the Croydon Guardian from 1900 onwards yields nothing at number 5 (which was later renumbered to 222 London Road) until a Farrow’s Bank advert in July 1905.

- Date of opening of Farrow’s Bank branch is taken from an article on page 12 of the 18 January 1908 Croydon Guardian (“Farrow’s Bank”), which states that the bank was “started in a small office at 57, Gracechurch-street, E.C.” on 26 May 1904 before moving “to larger offices, at 29, New Bridge-street, E.C.” on 30 December 1904, and that it opened branches at Norwich in January 1905 and at “Royal-parade, Croydon” in February 1905. In line with this, Ward’s directories list Farrow’s Bank at 5 Royal Parade (later renumbered to 222 London Road) from 1906 to 1921 inclusive.

- Thomas’s date and place of birth are taken from Fifty Great Disasters and Tragedies that Shocked the World by E G Ogan, and are in line with his entry in the 1911 census. The Money-Lender Unmasked can be downloaded in several formats from the Internet Archive. Quotation regarding “grave social evil” is taken from page viii of the preface.

- Information about the Select Committee on Moneylending is taken from Credit and Community: Working Class Debt in the UK since 1880, Sean O’Connell, 2009, Oxford University Press (pages 134–137). The Moneylenders Act 1900 (63 & 64 Vict ch 51) is not available online, so I have taken information about its provisions from “Review of unconscionable transactions”, K L Fletcher, 1972, University of Queensland Law Journal 8(1), 45–59 (see page 57) and Credit and Community (see page 137).

Quotation on abundant credit is taken from “People’s banking”, an article on pages 20–21 of the first issue of The People’s Bank Gazette (September 1907). Other quotations are taken from Thomas’s letter to the Westminster Gazette, published on page 3 of the 26 September 1901 edition and reproduced here.

Some idea of Thomas’s objections to the Act can be gained from an article on page 13 of the 28 February 1899 Times (“Mr. Farrow on the Money-Lending Bill”), which describes a statement in which he points out “serious omissions from the Government’s Money-Lending Bill”, concerning subjects upon which the Select Committee had “expressed strong views” and whose inclusion in the legislation would be “unquestionably desirable”. These subjects included “eight important alterations in the [Bills of Sale] Acts of 1878 and 1882”, provision for “the hearing of cases in camera” in order to protect the borrower’s privacy, and the requirement for “every person or company carrying on a money-lending business [...] to keep regular and strictly accurate accounts of each transaction” and to “furnish, whenever necessary, a copy of the accounts”. (It should be noted that I haven’t checked whether these aspects did or did not make it into the final legislation.)

Quotations are taken from an article on page 8 of the 13 November 1901 Worthing Gazette, which states that Thomas “wields a vigorous pen” and that the pamphlet “subjects to close scrutiny the working of the Money-lenders Act of last year”, and from another article on page 2 of the 9 November 1901 South London Press, which states that Thomas “trenchantly exposes the failure of the Money-Lenders’ Act”. The first of these gives the title of the pamphlet simply as The Money-Lenders Act, 1900.

Regarding the lack of results from this pamphlet, a chronological search of the British Newspaper Archive for “Thomas Farrow” from November 1901 (the intended date of publication of his pamphlet according to his Westminster Gazette letter) to February 1903 (the date of the first Croydon Religious Discussion Society meeting regarding a credit bank) reveals no national activities, only aspects of his life in Croydon: the birth of a child, correspondence with the police over crime in Waddon, and his activities as founder and president of the Croydon Religious Discussion Society.

- Name of Thomas’s wife is taken from the census (see below). Regarding their residence in Croydon, Ward’s directories list Thomas Farrow at 19 Waddon Road in 1894, 1895, and 1896; and at Norfolk House, 60 Waddon Road, from 1897 to 1903 inclusive (albeit as Thomas “Furrow” in 1897). While “Thomas Farrow” is not a completely unique name, the 1901 census confirms that the Norfolk House one at least was our Thomas Farrow (and Ward’s directories also show that 60 Waddon Road was renamed from Waddon Villa to Norfolk House at the time Thomas moved in, which given that Thomas was born in Norfolk does provide further evidence). The 1911 census shows that Thomas and Beatrice had been married for 18 years at that point, implying that they married around 1893. Regarding the Croydon Religious Discussion Society, an article on page 5 of the 27 December 1902 Croydon Guardian (“Croydon’s Religious Census and its lessons”) describes Thomas as “founder and president” of the Society.

- Information and quotations regarding the February 1903 meeting are taken from an article on page 2 of the 21 February 1903 Croydon Guardian (“A co-operative credit bank for Croydon”).

According to an article on page 2 of the 22 August 1903 Croydon Guardian (“People’s Bank for Croydon”), Thomas’s intention was to open the bank on 1 September 1903. In line with this, Ward’s directories list the Croydon Mutual Credit and Deposit Bank at 69 North End from 1904 onwards. The bank also appears in the “List of Industrial and Provident Societies Registered under the Industrial and Provident Societies Act during the Year 1903” published in the report of the 1904 Co-operative Congress (see page 149).

It seems likely that the bank was in fact on the upper floor(s) of 69 North End, rather than on the ground floor. Its entries in Ward’s directories have it sharing number 69 with other businesses (e.g. in 1904 it’s joined by Beringer & Strohmenger’s Piano & Music Warehouse as well as the Florentine Art Studio), and as can be seen in both my photo of the ground floor in 2014 and Brian Gittings’ photo of the full height in the mid-1980s, 69 North End does not have a particularly large frontage. Moreover, in the abovementioned “List of Industrial and Provident Societies” its address is given as 69a North End, not just 69. Finally, an advert on page 5 of the 29 August 1903 Croydon Guardian states that the entrance was on Drummond Road, likely corresponding to the side entrance there today (see my photo from 2015).

- Quotation is taken from an advert on the front page of the 15 August 1903 Croydon Chronicle (reproduced here), which also confirms the address of 69 North End, gives Thomas’s name as Chairman, and lists the members of the bank’s “Council of Supervision” as Alderman J Thrift, JP; Councillor J M Newnham, LLD.; and Councillor J Trumble. The first of these, John Thrift, also had a London Road connection, as he and his wife Amy lived there from around 1880 to the ends of their lives. They first moved to Arundel House, which is now 158 London Road (though I actually cover it in my article on number 156), and then to Sandhurst, which stood where Panton Close now is. More information about John and his work as a grocer and local politican can be found in the latter article. The full first names of Councillors Newnham and Trumble are taken from a letter authored by them on page 2 of the 9 April 1904 Croydon Guardian; this letter also states that the bank had previously been (but was no longer) affiliated with the National Co-operative Banks Association.

- Information and quotation taken from letter signed “A Shareholder”, published as part of the “Editor’s post-bag” on page 3 of the 13 April 1904 Daily News. Regarding the rate of interest, a letter from Thomas Farrow published on page 3 of the 16 April 1904 Daily News explains the situation from his point of view: “What I said was that the maximum interest charged to borrowers was 10 per cent., that the principal and interest were repaid by agreed instalments, and that if the Committee could by skilful management regularly and automatically invest and reinvest these sums, they would succeed in earning for the bank 17½ per cent. per annum.” However, another letter on the same page from James Trumble — who at the time of the general meeting was still on the Council of Supervision — states that he “can vouch for this [17.5%] as being the actual rate charged in the majority of cases”.

- John Thrift, the third member of the Council of Supervision, died in October 1903; see my article on Panton Close, which covers the site of his London Road home.

- Quotation taken from a letter on page 5 of the 9 March 1904 Oxfordshire Weekly News. A search of the British Newspaper Archives reveals many similar letters around the same time to different local newspapers; though interestingly some of them (including the one published on page 7 of the 5 March 1904 Croydon Guardian) omit the part quoted here about differences from the Croydon “scheme” and freedom from restrictions.

- See earlier footnote for evidence on Farrow’s Bank dates and addresses.

- Quotations here and in the previous paragraph are taken from Thomas’s letter to the Croydon Guardian, published on page 3 of the 16 September 1905 edition under the heading “‘The battle of the banks.’ Mr. Farrow’s reply to criticisms”.

- Quotation from Charles Mann is taken from his letter to the editor of the Croydon Guardian, published on page 10 of the 5 August 1905 edition. The letter is signed “For the Committee, C. Mann, Chairman”; I have assumed this to be the “Charles Mann” named as a member of the Committee of Management in the Croydon Mutual Credit and Deposit Bank advert reproduced here. Information on Thomas’s letter to the shareholders is also taken from this article. Information and quotations regarding the unoffical meeting are from an article on page 10 of the 19 August 1905 Croydon Guardian (“Croydon Mutual Credit Bank and Mr. Farrow”).

- A report on page 3 of the 17 February 1906 Croydon Chronicle describes that year’s annual meeting of the Croydon Mutual Credit and Deposit Bank shareholders, where Charles Mann “pointed out that despite all the efforts of rivals, and the attempts to get the bank to amalgamate with the rival concern, they were in a flourishing condition, and had been doing increased business.” According to entries in Ward’s directories, the bank continued to operate until the 1930s, being listed at 69 North End from 1904 to 1923 inclusive; at 78 North End from 1924 to 1928; and at 7d Mint Walk in 1929, 1930, and 1932 (but absent from both Mint Walk and the alphabetical list in 1934).

- Regarding the Croydon branches, an article on page 12 of the 18 January 1908 Croydon Guardian (“Farrow’s Bank”) states that a branch will be opened at 315 Brighton Road, South Croydon, on the 20th of that month, and a small notice on the front page of the 8 October 1909 Surrey Echo states that Farrow’s Bank “have opened a central branch at 35, High-street” in order to “meet the convenience of and in response to the request of a large number of Croydon tradesmen”. Regarding the other branches, an article on page 10 of the 21 December 1920 Times (“Farrow’s Bank”) states that at that point the bank had “73 branches, of which 21 are in the London district, 10 in Scotland, three in Ireland, one in Wales, and 38 in the provinces.”

- Quotation regarding the “Great Bank for Small Deposits” is taken from an advert on page 10 of the 30 April 1910 Croydon Guardian. Banking by post is mentioned in many of Farrow’s Bank’s newspaper adverts, including one on page 11 of the 26 March 1910 Croydon Guardian. Similarly, interest on current accounts is also mentioned repeatedly, including in the Surrey Evening Echo advert reproduced here (at 2.5% on credit balances of at least £10). Quotations regarding banking for women are taken from an advert on page 7 of the 8 July 1910 Votes For Women.

- Number of branches; sizes of dividend, assets, and net profit; and information on payment suspension and liquidation petition are taken from a report on page 10 of the 21 December 1920 Times (“Farrow’s Bank. Payment suspended. An auditor detained”, continued on page 12). Quotations are taken from an editorial article on page 11 of the same edition (“Farrow’s Bank failure”). Information on arrests is taken from an article on page 10 of the 22 December 1920 Times (“Farrow’s Bank arrests. ‘Shocking fraud’ alleged. Chairman in custody”).

The first two quotations are taken from the reports of Thomas Farrow’s and William Crotch’s speeches at the 16th annual meeting of shareholders, reported in the October 1920 edition of Farrow’s Bank Gazette (pages 38 and 39 respectively). The third and fourth quotations are taken from an article on page 10 of the 20 January 1921 Times (“Farrow’s Bank losses”, continued on page 12); the third describes evidence given regarding “the annual balance-sheets of the bank” by an official from the Company Registration Department at Somerset House, and the fourth describes the opinion of a potential investor who had asked an independent accountant to examine the books and thus uncovered the fraud in the first place.

Information on salaries and earnings for 1920 (£59,621 and £59,266 respectively) is taken from an article on page 12 of the 11 June 1921 Times (“Farrow’s profits”). Information on total net loss is taken from “Farrow’s Bank losses”, as above, which lists the net losses year by year from 1909 onwards (as discovered when a proper audit of the accounts was finally made) and states that the bank’s auditor kept a “locked cupboard” containing “false balance-sheets”, describing how he “prepared a first edition of the balance-sheet, showing the real deficiency for the year, and then wrote off from those figures certain depreciation which had to be written off. When he found what the total deficiency was he had to provide for it [...] and did so”. Some examples of how the deficiencies were “provided for” are given in a later article on page 5 of the 25 January 1921 Times (“Farrow’s losses £2,800,000”). The fifth quotation is from an article on page 7 of the 8 March 1921 Times (“Farrow’s Bank. Case for prosecution closed”), describing evidence given by a partner in Price, Waterhouse, and Co who had been appointed special manager of Farrow’s Bank the week before.

- Information on date of start of trial and quotations re charges are all taken from “Farrow’s Bank losses”, as above.

- Information and quotation re Army veteran are from an article on page 5 of the 1 February 1921 Times (quotation represents the veteran’s own opinion of Thomas’s letter), and information and quotations re railway clerk are from another article on page 7 of the 26 January 1921 edition (“Farrow’s balance-sheets”).

- Times 9 June 1921.

- Times 10 June 1921.

- Quotation re foolhardiness is taken from an article on page 7 of the 17 June 1921 Times (“Farrow’s balance-sheets. Crotch in the witness-box”), and longer quotation is taken from another on page 6 of the 18 June 1921 edition (“Crotch’s apology”).

- Quotations are taken from an article on page 7 of the 22 June 1921 Times (“Farrow’s Bank. All accused found guilty”). Other information about Thomas’s claims is taken from Matthew Hollow’s detailed study of Thomas’s attitude toward and culpability in the failure of Farrow’s Bank (“The 1920 Farrow’s Bank failure: a case of managerial hubris?”, Matthew Hollow, 2014, Journal of Management History 20(2), 164–178), which cites Director of Public Prosecutions case papers (DPP 1/55) as the original source.

- Information on sentences is taken from “Farrow’s Bank. All accused found guilty”, as above.

- This notice, which is on page 20 of the 14 May 1921 Times, offers “the Interest of the Bank in their undermentioned Branch Premises”, which in this context must mean the leasehold. 222 London Road is not mentioned by address, but as the “Croydon, W” branch, i.e. West Croydon.

- Downloading or copying this image for use by third parties or end users is strictly prohibited by RBS Archives, except for private study.

- Information on the mergers that created the London County Westminster & Parr’s Bank is taken from the “National Westminster Bank Plc” section of Handbook on the History of European Banks, 1994, European Association for Banking History (pages 1234–1235). Parr’s Bank, the London and Westminster Bank, and the London and County Bank were the main constituents of the London County Westminster & Parr’s Bank, but all three had absorbed other banks during their time.

- Information on opening date and operating hours of the West Croydon branch and date of the company’s rebranding was provided by Sophie Volker of the RBS archives (via email, 9 March 2020). Ward’s directory (which finalised the data for each edition toward the end of the preceding year) lists the Lon[don] County Westminster & Parr’s Bank in 1923 and the Westminster Bank from 1924 onwards.

- Downloading or copying this image for use by third parties or end users is strictly prohibited by RBS Archives, except for private study.

- Information on freehold acquisition was provided by Sophie Volker of the RBS archives (via email, 9 March 2020). Information on merger is taken from Handbook on the History of European Banks, as above (page 1236).

- The planning application (ref 78/20/131) for “Use of ground floor shop as extension to bank premises” is dated 18 January 1978 and states that the “Shop unit [at number 224 was] understood to be vacant for at least six months”. The stated reason for the application is that “Property adjacent to existing Branch has become vacant and the applicants wish to extend their Branch to improve facilities for customers”. More information on Sport Craft will be provided in my next article. Regarding the façade being in place by 1980, see the photo from that year reproduced here.

- Downloading or copying these images for use by third parties or end users is strictly prohibited by RBS Archives, except for private study.

- Via email, 16 May 2018. John worked in the Minster Insurance computer room at Zodiac House from 1979 to 1988.

- Via email, 10 July 2019. I have corrected a couple of minor typos and separated Dave’s text into paragraphs.

- Date of closure provided by Sophie Volker of the RBS archives (via email, 9 March 2020).

- All information and quotations in this section are taken from the records of the relevant planning application (ref 95/1629/P). My notes don’t include the date of the application, but the letter from the Zodiac Court resident was dated 1 September 1995. The application was refused on 14 December 1995.

- Information taken from records of the relevant planning application (ref 97/1777/P). The quotation is from the agent’s covering letter, which goes on to say that “while my clients will not be carrying out the operation of use themselves they will ensure through the terms of the lease that their tenant carries out a sympathetic dining operation.”

- A planning officer’s report included in the records of planning application 98/1742/P, states that “The ground floor is currently being converted to a restaurant for which permission has been granted.” This application was for use of the first floor of number 222 as “kitchen area, staff room and toilets” and “erection of external ducting” in connection with the ground-floor restaurant use; it was refused on 24 March on the grounds that the ducting “would appear incongruous in relation to the existing building” and the use of the first floor would be “detrimental to the amenities of the occupiers of adjoining residential property by reason of noise and disturbance”.

- The July 1999 Croydon phone book lists Viet Hoa at 222 London Road. The applicant in the first-floor planning application mentioned in an earlier footnote (ref 98/1742/P) is given as Mr & Mrs Quyen Chi Ly. A later planning application (ref 03/1588/P) states that the owners of the land are Mr & Mrs Ly, Viet Hoa Café, 70–72 Kingsland Road. The latter was still in existence when my informant bob walker visited in December 2019 (see account of this and a previous visit for more information and links to photos of the food).

- The second edition of Shop ’Til You Drop, probably published around 2002, lists “Tasty House — Chinese restaurant” at 222 London Road. Neither Viet Hoa nor Tasty House appears in the January 2001 Croydon phone book.

- Savana Restaurant is absent from the January 2001 Croydon phone book, but is listed at 222 London Road in the 2002 edition. According to Companies House data hosted on the CompanyCheck website, a limited company known as Savana Dine & Dance Ltd was incorporated on 8 March 2002 and had an address of 222–224 London Road, Croydon. A list of site visits by Croydon Council included in the records of a later planning application (ref 03/1589/P) show a visit to “Savanah” [sic] on 18 November 2002 at the request of a Mrs Dell who was “taking over” the premises, and a complaint dated 30 April 2003 from a Nova Road resident regarding rubbish being dumped by “Restaurant Savannah” [sic].

- On 30 June 2003, Mrs D Dell of 23 Brigstock Road applied to Croydon Council for permission to change the use of the first floor at 222 London Road from residential to a bar/lounge auxiliary to the restaurant on the ground floor (ref 03/1588/P). The records of this application include a letter dated 29 April 2003 on headed paper stating that “Hummingbird UK Ltd” had “recently secured the lease for the ground and 1st floor” at 222–224 London Road and now wished “to trade as a restaurant providing dinner and dance, operating predominantly on a membership basis.” Also in these records is a compliment slip with a logo consisting of the name “Hummingbird Restaurant” in all capitals running along two sides of a large “HQ”, with “French Caribbean Cuisine” in smaller capitals underneath. The address on the slip is 23 Brigstock Road, Thornton Heath. Croydon phone books list Humming Bird at 23 Brigstock Road from 1999 onwards (it’s not there in 1995; intermediate editions not checked).

- Information and quotations are taken from the records of planning application 03/1588/P, which was refused on 27 October 2004.

- As noted in an earlier footnote, the Humming Bird Restaurant logo also included the letters “HQ”, suggesting a connection between the restaurant and Bar HQ. Moreover, Google Street View imagery from July 2008 shows the premises with a “Humming Bird Restaurant” sign and “Bar HQ” logos in the windows. Information on “Sexy 1st Fridays” is taken from a 1 February 2006 post on the VIP2 Forum from a user, “Uncle Larry”, who was booked (presumably to DJ) at the 4 February event (though since the first Friday of February 2006 was actually the 3rd, one hopes that Uncle Larry checked the calendar before turning up). Other information is taken from planning application ref 07/03731/P. Regarding this, it should be noted that in my experience something described on a planning application as a “current use” is not necessarily the actual current use; sometimes, the property is actually vacant and the use stated as the “current use” is in fact the last previous use.

- Google Street View imagery from July 2009 shows the building covered in scaffolding, and imagery from November 2010 shows that at that point the Hummingbird Restaurant sign had been removed and building work was going on inside. The fact that Lobo Halal Meat was open by January 2012 is from personal observation (see my photo from that month, reproduced here). Confirmation that Lobo Seafood and Lobo Halal Meat had the same owner comes via an email from Aloysius Lobo (9 January 2019).

- I’m not entirely sure when the division happened. My observational notes from the time have it as happening some time between December 2015 and July 2016, but Google Street View imagery from June 2015 (which for some reason is no longer available) does suggest that number 224 might have already been divided off by then.

- Departure of Lobo Halal Meat by October 2016 is from personal observation (see my photo from that month), and the fact that Supreme Butchers rented the premises rather than buying the freehold is from an email from Aloysius Lobo (9 January 2019). Information on Supreme Butchers today was provided by bob walker after a visit in March 2020.